De-Risking your STR business

Originally posted on SmartHosts.org, some artwork has been removed.

We look at the major trends affecting many short-term rental (STR) businesses. Could your business fall off a cliff tomorrow or require immediate attention to ensure continuity?

We have created two sections:

- Why is there a growing risk to short-term rentals, including urban and leisure and why no one is safe?

- How to de-risk and analyse the challenge and adopt new strategies.

RISK ONE: The Anti STR - Airbnb train keeps rolling.

Across the globe, we see local and national authorities challenging the growth of short-term rentals and the theorised reduction in available residential letting and uptick in public service pressures. a few examples and a global reference are shown below.

In the context of this article, we do not mention Booking dot com or VRBO. Although they contribute to the problem, the generic Airbnb term and their particular push specifically into urban short-term rentals to having over 6m properties live and over 4m hosts is, we believe, the major contributor and suffering from its own success. Airbnb also gets around three times as much web traffic as VRBO, and Booking dot com is a hotel booking magnet despite its equally large "alternative accommodation" spaces.

1. Example Greece (Europe)

The Greek government plans to modify the legal and tax structures concerning approximately 145,000 residences due to the tenfold increase in short-term rental revenue, which currently stands at 530 million euros. Property managers would be separated from owners with one or two properties, and restrictions would be placed on the number of days a property can be rented out in a year.

Large real estate firms will need a special operating badge and may face residence and VAT fees mirroring those placed on hotels. Platforms like Airbnb are VAT-exempt, but a pan-European VAT may be applied starting in 2025. The 6% VAT rate for tourism packages will be retained, and accommodation fees between 0.50 to 4 euros will be imposed. The government also intends to implement a fee to support the housing needs of civil servants struggling to find affordable accommodations.

2. Example Dallas (USA)

In June 2023, the Dallas City Council voted to ban short-term rental properties such as those offered by Airbnb and VRBO in most Dallas neighbourhoods, instigated by the Dallas Neighborhood Coalition. Dallas's new zoning laws, which will be enforced by the end of the year, represent the most substantial ban on short-term rentals in a major city to date. The decision was also influenced by the national housing shortage, as residential properties used as short-term rentals limit the housing supply for potential long-term residents.

Closer to Home: Scotland, Wales and England (UK)

Scotland's licensing scheme has been challenged in court and found to be wanting, and now, with a deadline of 1st October across Scotland for STRs to obtain licenses, thousands have not even applied. This is the England Govt. research briefing.

Trading without a license could be considered a criminal action. England will result in registrations needed for rentals, and Wales is on course to controls to be put in place.

4. Global Summary

To see a global major conurbation summary of the current and trending legislation, this excellent White Paper from Situ, a global serviced accommodation specialist, gives an excellent and current overview of the market across continents. Based on interviews with industry leaders and partners in Situ's global supply chain, the research looked at locations including London, Edinburgh, Dublin, Paris, Amsterdam, Brussels, New York City, Boston, Singapore, and Sydney. The paper highlights each city is unique, with various influencing factors such as strict regulations, global and local economic climates, post-pandemic travel changes, and peak times demand. The research also points out the challenges presented by the rise of digital booking platforms and their impact on housing markets and local neighbourhoods. The paper also examines the investment climate for extended-stay accommodation in London and European cities.

More Reading

Just in case you are still relaxed about the whole situation, this excellent and monstrous report from the Research Trust Group will highlight the direction of the authorities, the counter-lobbying and push-back from commercial quarters. Page 60 is the summary of this report from Feantsa about Paris and Airbnb.

Commonality of Issues

The problems are essentially fourfold:

- Reduced availability of housing for residential letting, significant rental increases for those that are available and creation of ghost towns in the super popular, expensive and idyllic locations. Lack of accommodation also results in less local or seasonal labour for tourism.

- Overtourism, which compounds available accommodation for locals and workers

- Disturbances in residential neighbourhoods

- STRs are a hospitality business, and the average host is not aligned with this perspective. Fire regulations and noise control, and facility management are examples.

Media Damage

"If it bleeds, it leads" is a media and newspaper byline. Airbnb, the investor's baby and the real estate company's best friend for a few years

is slowly becoming a pariah in certain quarters, and the publicity keeps giving, such as these two:

A man from Florida, Konrad Bicher, nicknamed himself the "Wolf of Airbnb" and has pled guilty to a wire fraud charge, confessing to illegally acquiring about $2 million by defrauding landlords and manipulating a government pandemic program. Bicher, 31, agreed to a potential prison sentence of four to five years, which he will not appeal, despite the fact that the wire fraud charge could result in a 20-year sentence. He also consented to forfeit $1.7 million and pay restitution of $1.9 million. Bicher was found guilty of signing lease agreements under false pretences. He used the COVID-19 pandemic as an excuse not to pay landlords while operating at least 18 apartments in Manhattan as mini-hotels.

Airbnb sued over the death of a 24-year-old from Carbon Monoxide poisoning.

The suit, filed in California Superior Court in San Francisco, states that on October 5, 2022, Sebastian turned on the hot water heater in the bathroom to take a shower. Due to what a Brazilian police investigation revealed was an improperly installed and damaged exhaust duct, the hot water heater began emitting dangerously high levels of carbon monoxide into the bathroom.

Despite the incredible growth and size of Airbnb and its global brand, and its PR and damage limitation machine, it has thousands of negative contributors: These are some popular links and are just the tip of the iceberg

- https://www.boredpanda.com/customers-complain-roast-airbnb

- https://www.reddit.com/r/mildlyinfuriating/comments/y83hnh/if_you_needed_another_reason_to_hate_airbnb_2/

- Even Airbnb's own community

- A whole website called Airbnbhell

What is the outcome of legislation, local pressure and media influence?

Will it be as shown in Dublin (Ireland) and other European cities? The decrease in short-term rentals in Dublin exceeds that seen in other popular cities like Amsterdam (54.5% decrease), Prague (52.4% decrease), Berlin (38.6% decrease), Budapest (33.8% decrease), and Rome (19.3% decrease). These statistics may prompt inquiries about the 2019 restriction on short-term rental listings in Dublin, a measure initiated due to apprehensions regarding its influence on residential accommodation availability amidst the city's housing crisis.

Let's have a closer look using Porto in Portugal as an example.

Porto is a great place to visit for many reasons the culture, the cuisine, the climate, the cheap flights and lower prices compared to comparable European destinations, to name a few.

All the reasons tourists and digital nomads head there and reasons investors and locals saw opportunities to "Airbnb". In 2019 Porto ranked 12th in the number of tourists per capita, as shown by the image to the left and the table below:

Quite an unbelievable 36 tourists per inhabitant in Dubrovnik, and we are witnessing legislation enforced across many of the cities mentioned. Porto is a little later to the table but is closely aligned to Spain, with the "bit between its teeth."

The European Commission has proposed new rules for collecting and sharing short-term rental data to find out more about who’s staying where and for how long across the single market. All hosts and properties will have to follow the same online registration procedures and will have a unique identification number - harmonising data and helping the fight against illegal short-term rentals, which adds to the volume scraped by data companies such as AirDNA and PriceLabs.

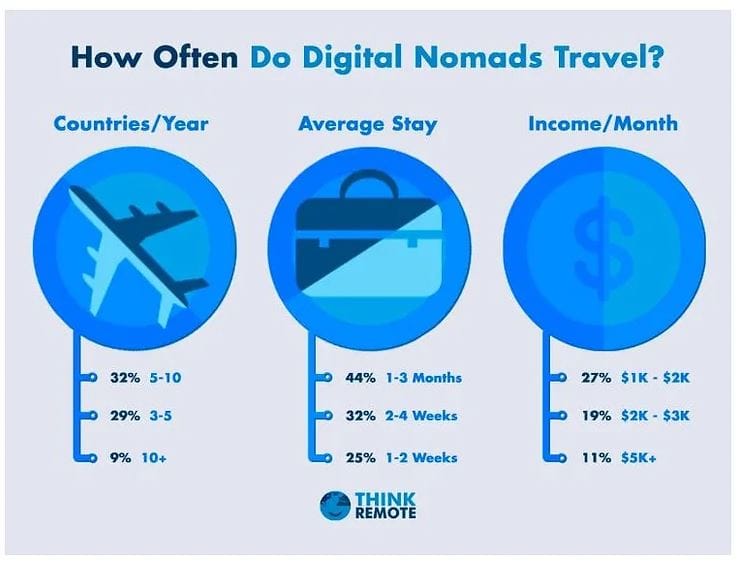

The rise of digital nomadism and "global citizenship" also represents a significant shift in accommodation use and mid-term stays. According to Think Remote's 2023 estimates, about 35 million independent workers identify as digital nomads.

This situation led to the Portuguese Govt proposing new laws and rules for both residential letting with tax breaks but limiting rental increases and harsher rules for short-term rentals or Airbnb as they are referred to. They also reversed the Golden visa privileges, which saw property investment predominantly.

The Portuguese government's proposal involves the following key points:

- New Local Accommodation licenses are to be prohibited, except for rural accommodations that could positively contribute to local tourism. All holiday rental owners must have an Alojamento local license (also known as an AL license) whether they own a house, apartment, lodging establishment or room.

- The restrictions also dictate how owners of holiday rentals should manage their guests during their stay. This is to ensure that they remain compliant with the rules and regulations set forth by the Portuguese government.

- Existing Local Accommodation licenses will be subject to reassessment in 2030.

- There will be an increase in tax rates for remaining Local Accommodation businesses.

- Those who remove properties from the Local Accommodation pool by the end of 2024 and put them on the rental market will be granted an IRS exemption until 2030.

In response to these changes, the Associação do Alojamento Local in Portugal (ALEP) expressed concerns that such measures would create immense uncertainty for private investment and render it impracticable. They inferred that the government might be seeking to eliminate "Local Accommodation", read Airbnb by 2030. Furthermore, the ALEP stated that Local Accommodation contributes to over 40% of national tourism accommodation and therefore deserves a different, more favourable approach. Read more here

The situation is as bad in The Guardian with over 15,000 digital Nomads and the same Golden Visa issues that stimulated the crisis too. This article in the Telegraph illustrates the true nature of the problem.

The net effect of low wages, a high number of second homes standing empty throughout Portugal (750,000), and the mass tourism monetising accommodation through Airbnb ensure that hammers are used to crack nuts, especially as politicians need votes and the poor outnumber the rich by far! This is happening across continents and is accelerating due to the current economic pressures.

RISK TWO: Price and Demand

If inventory drops, demand will either ensure higher ADRs or/and see reduced demand. Popular locations invariably see tourism, but this is also affected by many factors:

- How easy is it to get there? Cheap flights grew destinations. Think Bergamo in Italy, when Ryaniar started to fly there. If flights are not available, then demand drops. Airlines may change routes or make them less frequent without demand.

- OTAs as the booking kings of cities, especially Airbnb & Booking.com. If there are low levels of inventory and dropping demand, then the OTA will focus on that "experience" elsewhere.

- Airbnb has seen its fair share of criticism on prices, with absurd cleaning fees and other taxes, plus a large percentage of hosts and certainly managers uplift the ADR by the OTA commissions.

- VAT issues are on the horizon and awaiting decisions. The European Union, VAT in the Digital Age, is set to create a pan-EU VAT approach to short-term rentals. For our UK readers, this would mean that from 2025, any landlords who let out holiday accommodation located within an EU member state will need to pay an average of 20% VAT regardless of whether the landlord is residing in the same country or outside the EU. It is possible the Chancellor may monitor the success of the EU’s VAT in the Digital Age programme and consider taking a similar path to improve tax parity in the years ahead.

VAT, in theory, according to the documentation, means that the booking platforms would be collecting this, and that means a 20% increase on the booking tariff (who knows about the cleaning fees).

Tracking the situation is important, and these are recent actions, so we can expect little change, and this is reflected in the scrape of Airbnb by PriceLabs free Index tool as shown below:-

RISK THREE - OTAs and marketplaces

No one can doubt "the rise of the machines", and it's not a Terminator Movie: it's their technology that is beginning to realise its full potential, with STR having a household name (Airbnb) and with AI now breaking new ground with guest intelligence, communication and booking smarts. Can smaller companies compete? The answer is yes, still, but increasingly more challenging to play on a level playing field as this requires more investment and compliant connectivity and terms when using OTAs but increasing levels of activity to be heard and seen independently. Size counts and large managers can compete more successfully: smaller ones will see even more pressure.

RISK FOUR - Payments

Pre Covid taking payments was easy. Anyone could sign up for Stripe or one of the less well-known digital payment solutions or fight their local banks, who often demand security. Covid saw enumerable failures and card recharges. Risk is not something financial institutions like, and we have seen various ways of mitigating this by withholding funds on a rolling basis or incrementally higher fees and percentages across the board.

OTAs now offer payment solutions, such as Booking.com, VRBO, or Airbnb, which have retained funds until check-in since inception. This may make life easier for OTA bookings, but keeping all payments in one channel, especially when trying to dilute their power on your business, is risky. However, STR are risky and frequently carry bad press. Expect to see OTAs focus their attention more and more on payments. It adds control.

RISK FIVE - Technology

There is no need to discuss this in any detail, but more tools are needed to compete on bookings, finance and administration and address guest and owner expectations. These are a few typical manager's set of tools, which can become overwhelming in their use and complexity:

- A PMS and a channel distribution system

- Operational management software

- A company finance system/tools

- Communication tools, internal and external

- Website and administration tools

- Guest app

- Automated door locks and entry systems

- CMS and Marketing Software

- Insurance and guest verification

- Distribution of tax and guest information to authorities.

Then they need to be used effectively and have sub-accounts and connections, social media, blogs and posts, and now AI to contend with. This is hardly the toolset of a small lifestyle business, and it's not inexpensive, i.e. costly.

DE-RISKING ~ DECISION TIME?

There is absolutely no doubt that there are challenges to running a STR business. These are increasing. Sure Airbnb loves hosts to grow and co-host, but all they do is attract eyeballs and facilitate a booking. They do not get their hands dirty and work at the sharp end. You are the ones taking a leap in the dark.

One thing is certain change is happening, and no single business is the same as any other, and all will be affected slightly differently.

Your options are limited:

- Continue as you are, and perhaps you have a small goldmine. Make the most of it.

- Grow and add resources and amortise across increased inventory and bookings.

- Consider a franchise and let them handle the tech. You, the owner and guest management and operations.

- Partner, sell or close the business.

Do a business risk assessment?

You may undertake fire risk assessments, so a business one makes complete sense. Ask yourself these questions:

- Am I worn out from years of running this type of business?

- Do you trust or can you afford someone to replace you

- Is legislation on the horizon in your locality, and what does this mean to owners and your business

- Is the competition increasing and prices or occupancy decreasing

- Is technology becoming overwhelming and too costly

- If you have staff, are they working in the correct positions? Try this tool: it has many followers and has amazing results: Culture Index

- Importantly do a P&L and cash flow based on risk and potential damage through increased costs, reduced occupancy and bookings and loss of owners through legislation.

If you decide that this is a business that can grow, maintain or preferably increase margins, then it may benefit from a de-risking approach anyway. Look at trends, research your local market and evaluate the best strategy and direction.

A De-Risking Trend ~ Longer Stays

Several trends in the market have been growing over the last few years, but Covid was an inflexion point and accelerator for one in particular: Mobility and the capacity to work from anywhere with internet access. Two statistics show the importance and opportunity:

This report in PhocusWire, "AIRBNB ACCELERATES SUPPLY GROWTH, LOOKS TO EXPAND BEYOND CORE SERVICE", has a comment from Brian Chesky:

Airbnb is also considering more features to support stays of one month or longer, which accounted for 18% of nights booked in Q2 up from 13% pre-pandemic and which Chesky said is creating a “new category that’s between travel and housing.”

“And I think in the next decade it will be a lot higher than 18%,” Chesky said. “You have hundreds of millions of people … that have some incremental flexibility that did not exist 10 or 20 years ago … long-term we’re very bullish [on this].”

A few other facts illustrate market changes, such as that millennials value work-life balance. 92% of people born between 1980 and 2000 identified flexibility as a top priority when job hunting. This leads to the digital nomads of the world. These stats are from "thinkremote.com"

- Digital nomads worldwide: 35 million

- Average digital nomad’s age: 32 years old

- Average salary: $120,512 per year

- Demography: Females (49.81%) and males (50.19%)

- Biggest challenge: Wifi and finding a good place to work

- Working hours: < 40 hours/week

- Workstations: 46% work from apartments and hostels, while 45% choose to work from cafes. 27% complete their work hours from an Airbnb, while 19% frequent coworking spaces during the working day.

Professions: Digital nomads usually belong to the fields of marketing, computer sciences, writing, design, and eCommerce.

- Gender: Among the digital nomad community, males (50.19%) and females (49.81%) split almost equally.

- Origins: 76% of digital nomads are white; 10% are Latino/Hispanic, 8% are Asian, and 6% are black. In addition, the most common digital nomad nationalities are American (31%), Portuguese (8%), German (7%), and Brazilian (5%) – 51% of digital nomads worldwide.

- Relationship Status: 66% of nomads said they are single, while 34% admitted that they are in a relationship. 66% of people in a relationship are married, while the rest are unmarried.

- Age: 33% of digital nomads are between 31 and 36 years old, while 29% are between 26 and 30. Finally, 18% were between 37-45 years old, and 11% were aged 60 or older.

For a substantial report on the change in work demographics in the USA, try this report from Pew Research.

BLEISURE OR BLENDED TRAVEL ~ A growing opportunity

Blended or bleisure travel's suitability depends on individual and company preferences. Its potential risks can be managed with clear company policies that distinctly define the boundaries between work and leisure during such trips. There are benefits to both parties:

- Improved work-life balance (Don't forget the millennials)

- Boosted motivation and job satisfaction.

- Cost savings.

There are dangers, ethical, legal, relationship challenges, fraud and more, but as a manager or professional host, this "corporate" market is attractive as serviced accommodation encompasses 1.3m properties worldwide, but STRs are in excess of 10m.

The compliance rules pre-booking are more focussed than your average OTA, with Heath and safety and insurance a top priority. Accommodation needs to be quality and suitable for working too. But an employee may prefer a beachside apartment to a city centre one or a family villa with their family and arrange details with their employer.

If you are not seeking alternative booking mixes and market watching, you may find that the legislative creep, oversupply and limited booking periods on short terms stay mean your business is dead on the vine (another market!).