Veeve & Under The Doormat Merge

Note: This article was initially written for RentalScaleup, by our Editor and replicated below with some minor changes.

The recent merging of Unique Ventures, trading as Veeve (originally Vive Unique) and Under The Doormat (generally used as one word as a Dot Com), both UK companies, may be a portent of more deals to come. The former company was founded in 2011, and the second was founded in 2014.

Both companies initially had an ambition to focus on managing and marketing properties.

Many words have been printed on both companies over the intervening years, in which we have witnessed a pandemic and its fallout. In addition, the acceleration of integrated technology, increasing Online Travel Agent (OTA) urban dominance and legislation, plus the world economies have also challenged businesses and investment.

Veeve: Taking The Capital Investment Route

In April 2012, Veeve launched its inaugural office in Hoxton, starting with a portfolio of 200 private home rentals. By May 2014, the firm had secured a £3.5 million investment from Smedvig Capital. The opening of a second office in Battersea followed this financial boost.

In a further show of confidence, Smedvig Capital increased its investment in Veeve in November 2015, bringing the total funding to £7 million. In 2016, Wyndham (a UK business later acquired by Platinum Equity) also invested an undisclosed amount. The comment in this Skift article indicates the focus and influence of Onefinestay’s acquisition in 2016 and the hit it later took on this investment.

“Veeve operates a business similar to Accor-owned Onefinestay. The partnership will see Wyndham support the expansion of Veeve both in London and abroad.”

UnderTheDoormat: Going the Crowdfunding Way

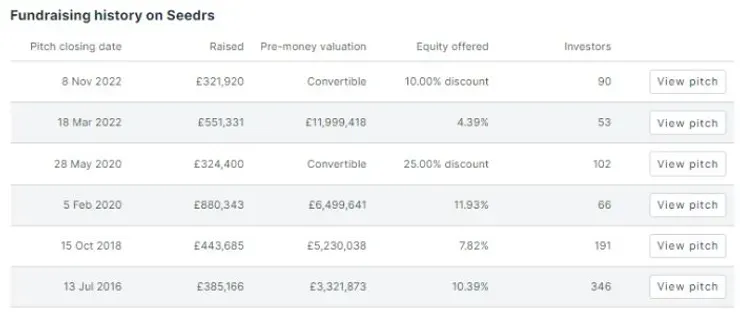

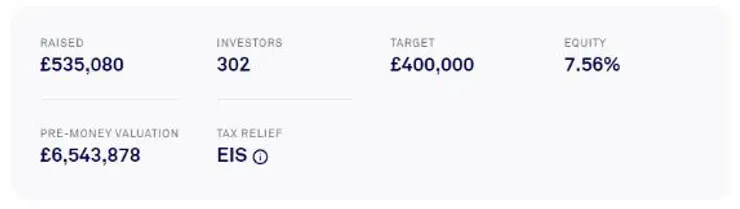

UnderTheDoormat took a different approach to funding with several Crowd Funding rounds on both Seedrs (a total of £2,906,845 and 501 investors)

and Cr0wdCube (2019)

Also, in 2023, a further CrowdCube round that, according to Crunchbase, raised £12.8K, which presumably was below the threshold and was not activated for equity release.

The companies are different in approach to their development. Veeve strongly focuses on London and Paris, listing 238 and 392 properties on their website. UnderTheDoormat appears to have 167 properties in London and another 50 scattered between Aberdeen, Birmingham, Cumbria, Durham, the Dordogne, Chicago, and Colorado. The London portfolio matches the Veeve focus, although Veeve itself has attempted expansion across the Atlantic, in Los Angeles, in 2018, quoting:

“We hold an exceptional portfolio of over 2,000 handpicked, lived-in homes to rent in London and Paris and are now excited to bring our high level of expertise to Los Angeles so that residents can join the Veeve experience.”

The number of properties has shrunk substantially over the last five years from that quoted in 2018.

There is an alignment of listing, managing and marketing properties between the two companies, especially in London. However, this is where the two companies diverge. UnderTheDoormat has three wholly owned subsidiaries, two of which are Hospiria Ltd, & Trusted Stays Ltd. The former is a “property management system”, and the latter is a site for corporate and government stays.

On Hospiria

It is certainly not unusual for companies to develop their technology, and we have seen others then market the product, such as GuestReady (another crowdfunded company) marketing RentalReady; however, it is fiercely competitive, and several US companies have seen sizeable investments (e.g. Guesty, Hostaway), with Europe and Rest of the world polarising into country-specific software. We now see Inhabit seeking to divest its portfolio and others, such as Avantio and Kross Bookings, which have been acquired, seeking rapid growth.

TrustedStays is an inventory aggregator, a different niche, and a pandemic-leveraged opportunity quoted as: “TrustedStays started as Homes for NHS, and we still work with the NHS and the Crown Commercial Service (UK Government)”. This publication gives a good overview of the contributors and scheme in that period. The GDS connection via Amadeus gives extra reach.

UnderTheDoormat has also breached Middle Eastern countries and recently gained news traction in this region, such as Oman, a far cry from a UK business and management focus and is mentioned as one target region in the press release for expansion.

The Merger

The press release summary:

“The recent merger, led by Smedvig Capital with a £4 million investment, positions Karr as the CEO of the combined entity, with Veeve acting as the consumer-facing brand and UnderTheDoormat as the holding company."

Key plans include focusing on the Paris Olympics and expanding their consumer short-term rental business. The company aims to grow its B2B segment, enhance real estate deals, and develop its tech brand Hospiria internationally. A pilot program with a UK property portal is expected to open new market channels for short-term rentals.

The merger, described as a union of equals, will not result in major layoffs. Instead, it focuses on leveraging the strengths of both businesses to foster growth and resource deployment.”

There certainly are advantages to companies:

- increasing their critical mass,

- reducing operational costs, and

- implementing self-developed software at scale. Presumably, this is the reason (although press releases indicate no significant loss of staff), plus the opportunity to raise more funds for growth.

Mid-term stays, a more diverse approach to urban apartments, and a property focus with more hotel-like service are developing markets and may be on their horizon. The question is where, and if the approach is too diverse across too many products and destinations.

Many UK-focused hyper-local small management businesses make credible amounts of profit, including hyper-scale companies such as Sykes. However, we see many “scaling” companies requiring increasing levels of investment to develop a brand or an efficient mechanism to realise sufficient margins and keep operational costs down. As we have seen with Sonder, diversification is an option but requires discipline and a laser-like execution.

Funding?

Crowdfunding is often overly ambitious in predictions, and in the last few years, the challenges with the COVID-19 pandemic and, more recently, the legislative pressures have made it difficult to predict the future.

Both companies have had funding, and both have accumulated losses. The public information shows that Smedvig Capital (already an investor in Veeve) led the merger with a £4 million investment, adding some runway comfort. Companies House in the UK reports that UnderTheDoormat recorded accrued losses of £2,047,909 for the financial year ending March 31, 2023.

Unique Ventures Ltd results up to Oct. 31, 2022, show accrued losses of £19,666,000 and reported losses of £1,840,00 in that period. Unique Ventures Holding, which owns 100% of Unique Ventures Ltd, reported a loss of £11,121,000, and investors contributed a further £1.5 million with the release of equity and convertible loans being realised.

The keyword in the industry is “focus” right now as speciality technical and niche distribution services continually appear on the market, often with US funding. Cost containment, rapid focussed inventory expansion, and integrated and improved technology will improve performance, and exclusive contracts with properties and owners or real estate leasing will always control distribution. Marketing and brand building is another discussion.

More funding would benefit the growth. With the market not as buoyant, legislation in the news across the EU and UK, and so many scale-oriented loss-making businesses, the market may not be as attractive to other investment bodies. This deal looks to have global ambitions (UK, Europe, Middle East, North America, and Asia, with core operations in London and Paris), multiple models in B2B and B2C and real estate in its sights.

One to watch as others fight for premium urban properties, the tech space and the market for supply and demand fluctuate in 2024. Expect to see more deals as 2024 progresses, and this one may make investors reconsider their positions. Not every business is an Airbnb!

Note: Companies House reports are not always transparent in detail and reporting, and the numbers shown are from each reported balance sheet submission and comments within the reports from directors